For another year, property in the UAE provides some of the highest rental yields around the world.

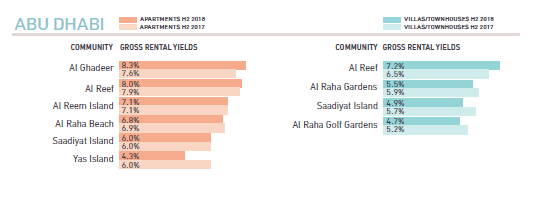

Abu Dhabi

In Abu Dhabi, we can see more affordable communities outperforming the more expensive ones. Despite price declines across the Emirates overall, strong rental demand means yields stay high.

Rental Yields: the rental income (the money a tenant pays to the landlord) divided by the purchase price of the property.

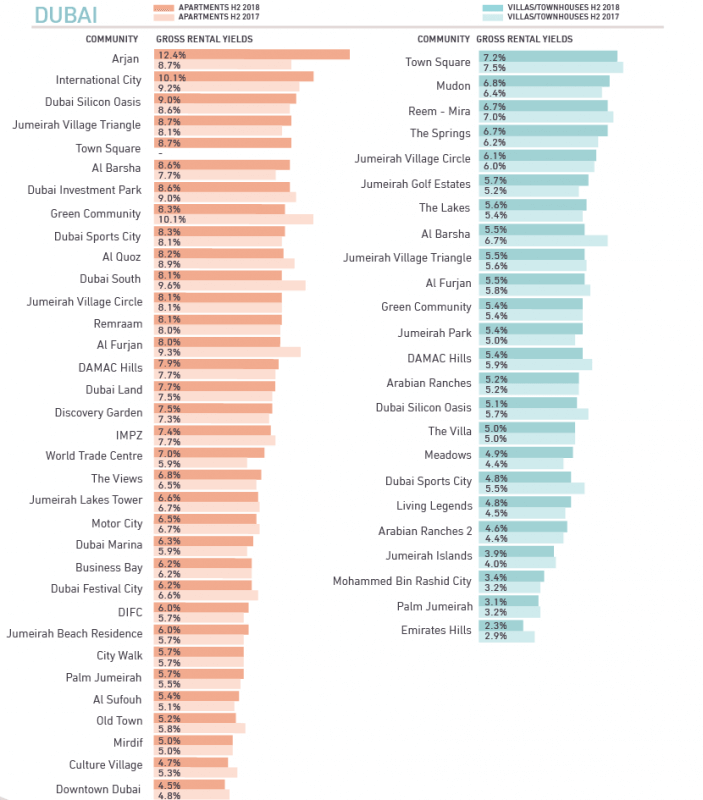

Dubai

Arjan topped Dubai’s list with 12.4% returns and International City improved to 10.1% from an already high 9.2% due to healthy demand from those migrating from other emirates.

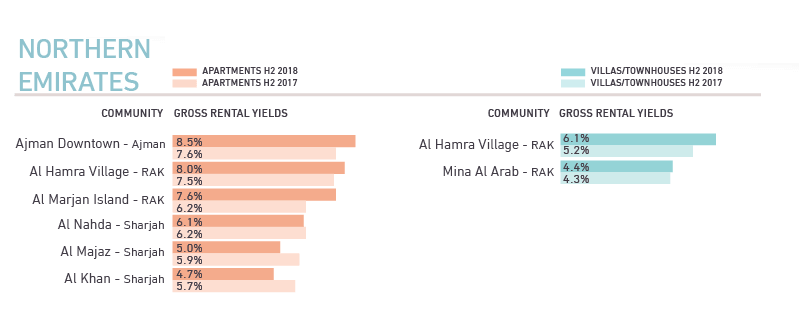

Northern Emirates

While Ajman and RAK saw rental yields increase from 2017 to 2018, rental yields in Sharjah declined as it saw a greater drop in rental prices. Notably, prices in Sharjah have declined due to migration into Dubai and Ajman. However, the introduction of free-hold status on property in Sharjah in 2018 will have an affect on prices in the years to come.

Gross rental yield = annual median asking price for rent / annual median asking price for sale.

*The data is based on the median advertised price on propertyfinder.ae and may not reflect the actual transacted price

This article was originally published in Property Finder Trends, Vol 5.