If ever there was a time to swallow your fear about buying property in Dubai, now could be it. Over 2018, I have noticed the market has shifted somewhat with more studio, one and two-bed apartment sales. Indeed, they seem to be dominating the sector right now.

This indicates it is now affordable for renters to get on the property ladder, which is a fantastic sign for first- time buyers and those wanting to put down roots in Dubai.

Providing more affordable housing in the market, including the release of new build units, has ultimately reduced the price of housing making it more affordable for people to commit to the city.

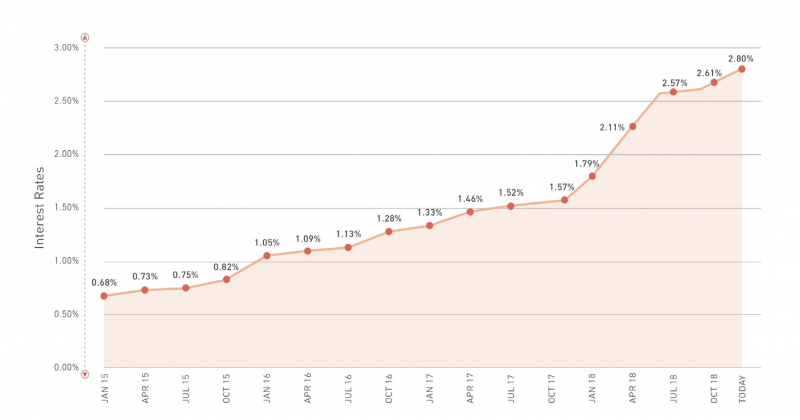

With the recent interest rate increase of 25 bps from the Central Bank, we will closely monitor the effects on lending rates for the next quarter and see if this will impact consumers’ decision to buy. However, with lending rates still as low as 3.24%, buying in the Middle East right now is still very attractive, similar to when the EIBOR was at its lowest point in January 2015.

Early Settlement Charges And Their Impact

The decision to increase early settlement charges has caused some turbulence, along with the possible increase in loan-to-value (LTV) ratios. The mortgage market has certainly had a shake-up.

Interest Rates – 2015 to Present

There are currently three different ways someone can close their mortgage:

• Settlement from their own funds

• Sale of the property

• Buy-out (moving their mortgage) to a different bank

The Central Bank had released a decree whereby banks could charge up to 3% of the outstanding balance to close a mortgage.

Each bank has their own position on these events and many haven’t directly defaulted to the maximum 3% charge. This is one of the many good reasons why it is so important to engage with a mortgage consultant.

Having access to the whole of the market to assess every product, my ultimate goal is to tailor a mortgage to suit each client’s need. As banks only have access to their own products, they cannot remain impartial.

Equity Release

Although the shift in the market has been towards first-time buyers, I have also seen a sharp incline of investors who bought their properties in cash and who are now releasing some funds from their units to increase their portfolios.

Whilst now may not be the best time to sell, it is an extremely fruitful time to buy. This allows investors and end users alike to benefit from the low market and not have to sell their assets in a decreasing market.

For your first property, at present you can avail 75% of your first purchase for expatriates and 80% for locals. For your second unit, this is restricted to 60%.

Many people are looking to upsize, whilst keeping their current property they are living in, and effectively releasing cash to use as their down payment on their new purchase – putting little or no cash in themselves.

Renting Versus Buying

Finally, the question of whether to rent or buy is a common but important topic I come across daily with my clients. For example, currently, the average price of a three-bed in the Springs ranges from AED 2.25 million to AED 2.5 million. Taking the average of this, AED 2,375,000, and comparing it to the average rental value of AED 150,000 per annum, it is 4% cheaper to buy than it is to rent.

For a true reflection of whether it is cheaper to buy than rent, make sure you find out the expected rental income of where you are looking to buy, not where you currently live.

Please refer to our online tool that will provide you with results of renting versus buying: propertyfinder.ae/en/rent-vs-buy-calculator

Personally, figures weren’t of optimum importance when I was looking at buying my own property. Investment is different, however. With my own purchase, I wasn’t considering if I would beat the market or sell double what I paid for it, that just isn’t realistic.

Since moving here six years ago I have moved six or seven times. Buying your own place puts an end to unreasonable landlords, change in your housemates’ circumstances and generally being tired of lining someone else’s pocket.

Since moving a couple of years back, I’ve made my house a home and now see my time in Dubai as being even longer term. Without the annual pain of renegotiating rent and the fear of having to move, which comes with their own stresses and costs, it made sense to buy than rent for more than just monetary reasons. Luckily, however, this also made financial sense for me.

Every market has its dips and peaks, so don’t be afraid of committing because you speak to people who will never have the confidence to buy. Many people have made very wise decisions and are now benefiting from those decisions as they move back home.

For independent mortgage advice to decipher whether buying is better for you, speak to one of Mortgage Finder’s qualified consultants to guide you through.

___________

READ MORE:

Property 101: Guide to Buying in Dubai

Property 101: Guide to Buying in Abu Dhabi

___________

This article was originally published in Property Finder Trends Vol. 5