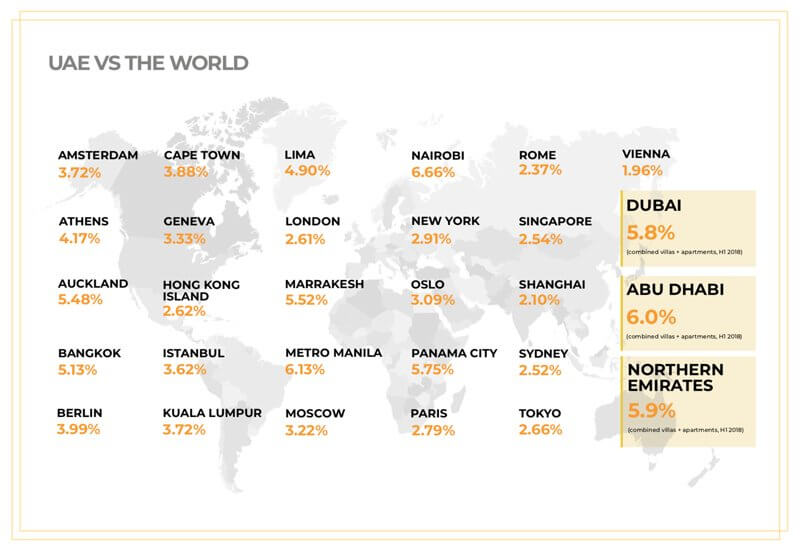

For investors focused on earning income rather than capital growth, rental yield is a crucial factor to consider. The good news is that the UAE has consistently maintained relatively stable yields from June 2017 to June 2018, ranking among the highest in the world.

In this article, we explore how Dubai, Abu Dhabi, and the Northern Emirates compare to other global cities and examine how rental yields have shifted across the Emirates over the past year. Whether you’re seeking insights or planning your next move, understanding UAE house rent trends is essential.

Rental yields explained

Rental yields are the rental income (the money a tenant pays to the landlord) as a percentage of the property’s value. It is fairly simple to calculate:

- Total annual rent divided by the property purchase price (or value) = gross rental yield

- Total rent minus property expenses divided by the property purchase price (or value) = net rental yield

- The result should be multiplied by 100 for the net rental yield percentage.

Rental yields are determined by a number of factors, according to Lukman Hajje, Chief Commercial Officer of Propertyfinder Group.

Typically, smaller properties produce better rental yields than larger ones. Apartments are better than villas, and studios are better than larger apartments, for example.” “But also consider location. Newer, emerging communities offer better rental yields than more established communities. Newer cities offer higher rental yields than established cities.

UAE ranks among the world’s highest yields

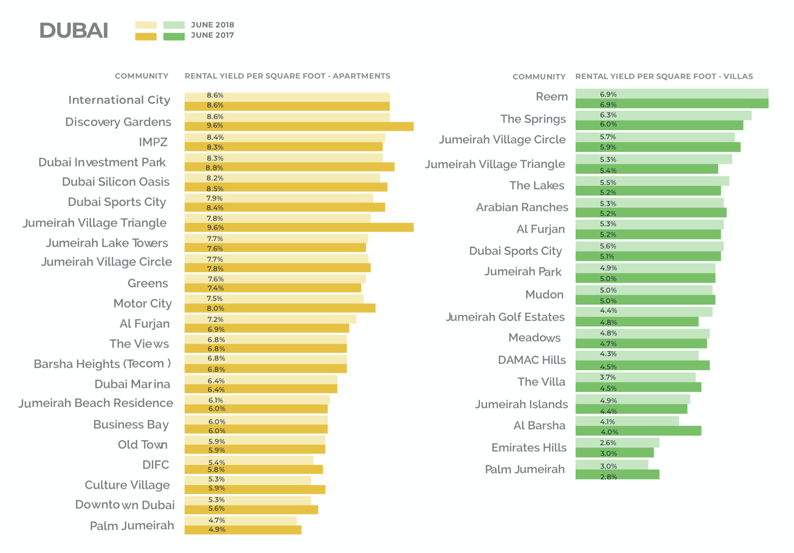

Rental Yields – Dubai

Incoming supply in Dubai is coming more heavily from emerging communities in the Dubai Land area as well as brand new master communities around Dubai South and is made up of about 80 percent apartments compared to 20 percent villas and townhouses.

Areas such as Sports City, Dubai Investment Park, Dubai Silicon Oasis and Jumeirah Village Triangle saw some minor declines due to a larger amount of supply coming in. However, areas with strong demand like Business Bay, Dubai Marina, Downtown Dubai, and Palm Jumeirah are consistently in demand and have therefore maintained stable rental yields. Other areas that are more affordable or are in high demand are Jumeirah Village Circle, International City, Sports City, and Motor City.See what other communities have held both rental yield and prices over time.

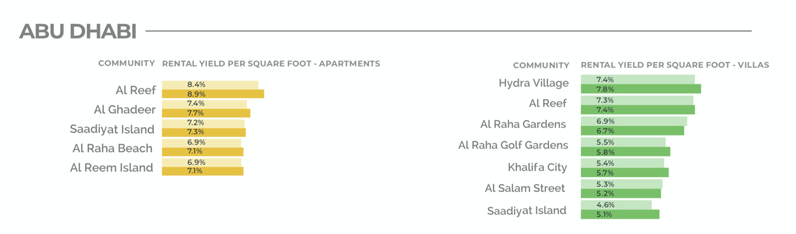

Rental yields – Abu Dhabi & Northern Emirates

Similarly to Dubai, minor declines in Abu Dhabi rental yields can be attributed to increased supply. Nonetheless, rental yields have also remained relatively stable in the capital.

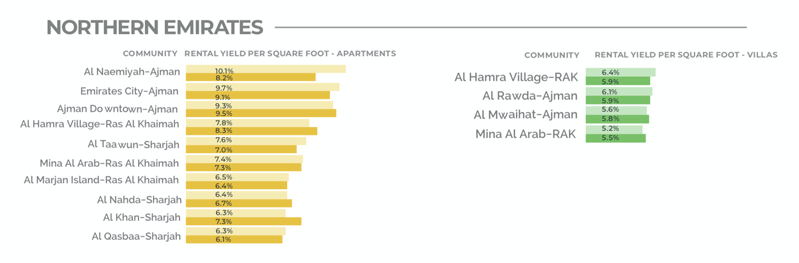

Supply is not introduced in the Northern Emirates at anything near the rate of Dubai or Abu Dhabi of course, so yields there fluctuate based on rental demand. Demand in RAK has been consistent as a result of the free zones that are being established. On the other hand, Al Naemiyah in Ajman saw a two percent increase in rental yields from 2017 to 2018. This can be attributed to an increase in rental demand there as Sharjah becomes crowded. There are also a number of new projects coming to Ajman, increasing its attractiveness.

If you are ready to buy an investment property, now is the time. High rental yields, dropping property prices, longer residency visas, and the option to stay in the UAE post-retirement are all working in your favour. Not only is the government working to incentivize investments, but the UAE ranks among the top rental yields in the world.For the latest prices and rental yields check out our House prices tool. This article was originally published in Property Finder Trends, Vol 4. Click here to read the full report online or download the PDF.