The UAE’s real estate market is surely among the most prominent and promising ones in the area. Either renting, buying, or even investing, it’s not an easy and quick decision as it has to be well planned.

To save your time and ensure you are on the right track, find below the market performance and trends with full insights across Abu Dhabi and Dubai.

You will know in detail about the sales transactions’ value and volume, the mortgage market, and the top areas to buy, rent, or invest. Besides, it includes insights about the off-plan and existing/ready sales markets, to find yourself the best option.

1. Abu Dhabi

Highlights

- According to the Department of Municipalities and Transport (DMT) data, in Q1 2023, the sales transactions made a significant record with 2,027 transactions which is a 46.6% increase compared to 1,383 transactions in Q1 2022

- The total value of the sales transactions has also jumped to AED 11.602 billion, which is an outstanding record compared to AED 3.633 billion in Q1 2022.

- The market value of the sales transactions achieved a notable year-on-year growth of 219.4% when comparing it to Q4 2022, which amounted to 77%. This owes to:

- The country’s great attraction to international investors

- The stable economic environment, when compared to the global one, which is quite unstable

- The revival of tourism

- The successful vaccination measurements and illuminating the Covid-19 restrictions led to getting back to the normal routine.

Total Sales Transactions

- Sales transactions in Abu Dhabi increased by 46.6% in Q1 2023.

- Off-plan: The total sales transactions volume is 1,345, while the value is AED 4,520 billion

- Existing/Ready Sales: The total sales transactions volume is 682, while the value is AED 7,082 billion.

Off-Plan Transactions

- In Q1 2023, the off-plan market continued its support to Abu Dhabi’s real estate market, with a great contribution to its growth.

- The market witnessed 1,345 off-plan sales transactions in Q1 2023, while in Q1 2022, it had only 713 transactions. This represents 66% of the total transactions; on the other hand, Q1 2022’s total sales transactions were 51.6%, which reflects an astonishing increase.

- The value of the off-plan sales transactions amounted to AED 4,520 billion, compared to AED 1,294 billion in Q1 2022.

- The market also witnessed a decrease of 3.1% in the off-plan transaction value in Q1 2023, compared to Q4 2022.

Existing/Ready Sales Transactions

- The existing/ready transactions in Q1 2023 witnessed a great increase of 276.9% compared to Q4 2022.

- In Q1 2023, the existing/ready market witnessed the registration of 682 ready properties, while in Q1 2022, it amounted to 670.

- The number of registered properties in Q1 2023, represents about 33.6% of the total transactions; relating to Q1 2022, the percentage back then was 48.4%.

This explains the moderate growth of 1.8% compared to the same period last year.

- On the other hand, the quarter-on-quarter performance had a recognizable growth as the number of transactions increased by 10% when compared to the transactions in Q4 2022.

- In Q1 2023, the existing/ready sales transactions value has a share of 61% in the total sales transactions value, which is a good increase compared to the last year’s percentage.

- The existing/ready transactions value reached AED 7.082 billion in Q1 2023, while in Q1 2022, it amounted to AED 2.339 billion, reflecting a remarkable increase of 202.8%.

High-in-Demand Areas for Sale and Rent

| Apartments for sale | Villas for sale | Apartments for rent | Villas for rent |

| Al Reem Island | Yas Island | Al Reem Island | Khalifa City |

| Yas Island | Saadiyat Island | Al Raha Beach | Mohamed Bin Zayed City |

| Al Raha Beach | Al Reef | Khalifa City | Yas Island |

| Saadiyat Island | Al Reem Island | Corniche Road | Al Reef |

| Masdar City | Khalifa City | Al Khalidiya | Saadiyat Island |

Property Sales Prices in Abu Dhabi

The table below shows the average asking prices for apartments in Abu Dhabi in Q1 2023:

| Three Bedrooms | Two Bedrooms | One Bedroom | Areas |

| AED 2,051,000 | AED 1,350,000 | AED 825,000 | Al Reem Island |

| 2,000,000 AED | AED 1,635,000 | AED 990,000 | Yas Island |

| AED 2,500,000 | AED 1,650,000 | AED 1,100,000 | Al Raha Beach |

| AED 7,100,000 | 4,000,000 AED | 2,110,000 AED | Saadiyat Island |

| AED 1,800,000 | AED 1,100,000 | AED 745,000 | Masdar City |

The table below shows the average asking prices for villas in Abu Dhabi in Q1 2023:

| Five Bedrooms | Four Bedrooms | Three Bedrooms | |

| AED 6,150,000 | AED 5,350,000 | AED 4,320,000 | Yas Island |

| AED 12,999,400 | AED 6,372,000 | AED 6,000,000 | Saadiyat Island |

| AED 2,500,000 | AED 2,200,000 | AED 1,600,000 | Al Reef |

| AED 11,000,000 | AED 3,700,000 | AED 3,450,000 | Al Reem Island |

| AED 5,200,000 | AED 5,300,000 | AED 3,500,000 | Khalifa City |

Property Rental Prices in Abu Dhabi

The table below shows the average rental prices for apartments in Abu Dhabi in Q1 2023 at the top preferences either for homeownership or investment in Abu Dhabi.

| Three Bedrooms | Two Bedrooms | One Bedroom | |

| AED 125,000 | AED 85,600 | AED 64,200 | Al Reem Island |

| AED 155,000 | AED 100,000 | AED 62,500 | Al Raha Beach |

| AED 85,000 | AED 64,247 | AED 42,000 | Khalifa City |

| AED 151,500 | AED 115,000 | AED 84,000 | Corniche Road |

| AED100,000 | AED 86,000 | AED 63,400 | Al Khalidiya |

The table below shows the average rental prices for villas in Abu Dhabi in Q1 2023:

| Five Bedrooms | Four Bedrooms | Three Bedroom | |

| AED 162,500 | AED 160,000 | AED 130,000 | Khalifa City |

| AED 150,000 | AED 130,000 | AED 130,000 | Mohamed Bin Zayed City |

| AED 300,000 | AED 280,000 | AED 235,000 | Yas Island |

| AED 150,000 | AED 138,000 | AED 100,000 | Al Reef |

| AED 600,00 | AED 420,000 | AED 375,000 | Saadiyat Island |

2. Dubai

Highlights

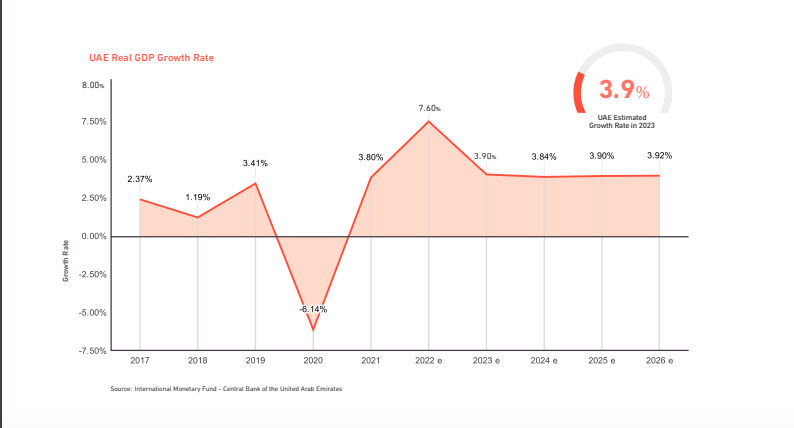

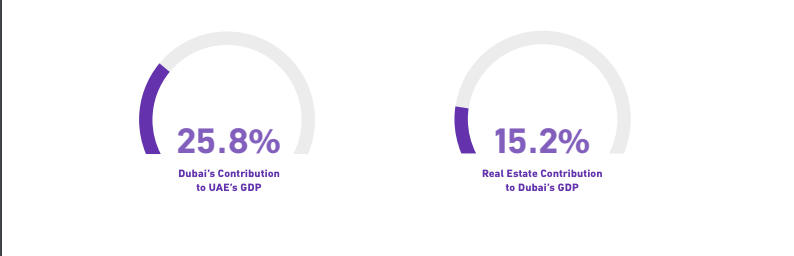

- Dubai contributes to the total GDP of UAE with 25.8%

- The real estate market contributes to Dubai’s total GDP with 15.2%

- The emirate’s economy is showing good progress in recovering from the pandemic consequences.

Total Sales Transactions Volume

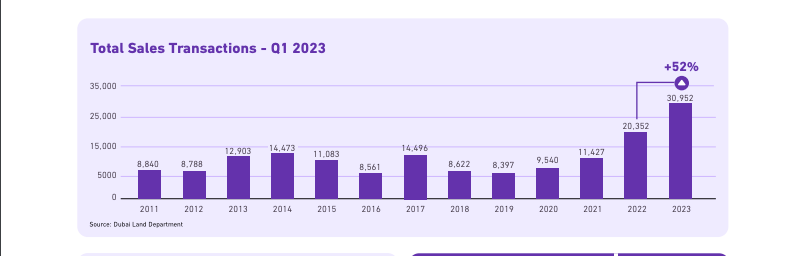

- 2023 started its first quarter with outstanding performance and a remarkable record ever recorded, with 30,952 total sales transactions compared to Q1 2022.

- Q1 2023 also recorded a significant increase of 52% YoY to be the highest performance for a quarter ever, owing to the great performance of the off-plan transactions.

Off-Plan Transactions

- A new record of off-plan sales in Q1 2023 is reaching 15,948 transactions with an 88.4% increase compared to Q1 2022.

- During the 1st quarter of 2023, the off-plan transactions’ share is of the total transactions, which is around a 10% difference compared to Q1 2022. This reflects the great support of the off-plans market to Dubai’s real estate market.

- The off-plan/primary introduced new high-profile launches to the market in Q1 2023, like:

- Lanai Islands in Tilal Al Ghaf

- The Residence at Burj Khalifa

- Jouri Hills in Jumeirah Golf Estates

- Bluewaters Bay on Bluewaters Island

- New launches in District One and Madinat Jumeirah Living.

- The diverse selection of projects that are newly launched offers you various options to enjoy a lavish living and a unique level of investment value.

Secondary Transactions

- The existing/ready sales witnessed a new record by reaching 15,004 transactions with a 26.24% increase compared to Q1 2022.

Total Sales Transactions Value

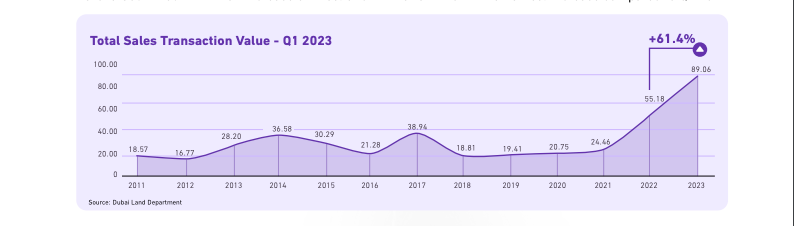

The strong economic growth and tourism industry are the reasons behind the high demand for housing; as a result:

- Q1 2023 recorded the highest value ever for a quarter with sales transactions amounting to AED 89.056 billion

- The value of the sales transactions increased by 61.4% compared to Q1 2022, making a new benchmark for the total sales value.

Off-Plan Transactions Value

- The off-plan sales value reached AED 35,74 billion transactions in Q1 2023, making a new record with a 124.6% increase compared to Q1 2022

- In addition, 40% of the total transactions value owes to the off-plan transactions, achieving an 11% increase compared to the same period last year.

Secondary Transactions value

- In Q1 2023, the secondary transactions sales value set a new record of AED 53.3 billion, marking a remarkable increase of 35.78% compared to the same period of the previous year.

- This marks the highest transaction value ever recorded for a quarter. It achieved a 15.53% increase from Q4 2022.

Total Rental Contracts’ Relative Distribution by Area in Q1 2023

New Rental Contracts’ Relative Distribution by Area in Q1 2023

Dubai rental market witnessed a number of new rental contracts by the different residents seeking new homes; find below the top areas where new leasing contracts took place:

- Jabal Ali Industrial First

- Al Warsan First

- Muhaisanah Second

- Jabal Ali First

- Business Bay

Renewed Rental Contracts’ Relative Distribution by Area in Q1 2023

The satisfaction and demand of the residents about certain areas was confirmed according to the numbers of renewed contracts in Dubai.

Here are the top communities that witnessed leasing contracts renewal:

- Jabal Ali First

- Naif

- Al Warsan First

- Al Karama

- Al Suq Al Kabeer

High-in-Demand Areas for Sale and Rent

The following table includes the top options for owning or renting an apartment or villa in Dubai.

| Sale | Rent | ||

| Apartments | Villas | Apartments | Villas |

| Dubai Marina | Dubai Hills Estate | Dubai Marina | Dubai Hills Estate |

| Downtown Dubai | Palm Jumeirah | Downtown Dubai | DAMAC Hills 2 |

| Business Bay | Arabian Ranches | Jumeirah Village Circle | Al Barsha |

| Palm Jumeirah | DAMAC Hills | Business Bay | Jumeirah |

| Jumeirah Village Circle | Mohamed Bin Rashid City | Jumeirah Lake Towers | DAMAC Hills |

Property Sales Prices in Dubai

The table below shows the average asking prices for apartments in Dubai in 2023:

| Three Bedrooms | Two Bedrooms | One Bedroom | |

| AED 3,600,000 | AED 2,200,000 | AED 1,350,000 | Dubai Marina |

| AED 6,300,000 | AED 3,750,000 | AED 1,799,888 | Downtown Dubai |

| AED 3,200,000 | AED 2,250,000 | AED 1,350,000 | Business Bay |

| AED 5,600,000 | AED 4,150,000 | AED 2,900,000 | Palm Jumeirah |

| AED 1,705,575 | AED 1,200,000 | AED 779,000 | Jumeirah Village Circle |

The table below shows the average asking prices for villas in Dubai in 2023:

| Five Bedrooms | Four Bedrooms | Three Bedrooms | |

| AED 8,250,000 | AED 5,825,000 | AED 4,800,000 | Dubai Hills Estate |

| AED 30,000,000 | AED 21,000,000 | AED 13,000,000 | Palm Jumeirah |

| AED 7,500,000 | AED 5,500,000 | AED 3,500,000 | Arabian Ranches |

| AED 7,600,000 | AED 3,640,000 | AED 2,750,000 | DAMAC Hills |

| AED 21,807,507 | AED 11,935,000 | AED 3,393,889 | Mohamed Bin Rashid City |

Property Rental Prices in Dubai

The table below shows the average rental prices for apartments in Dubai in Q1 2023:

| Three Bedrooms | Two Bedrooms | One Bedroom | |

| AED 242,995 | AED 158,000 | AED 110,000 | Dubai Marina |

| AED 402,500 | AED 220,000 | AED 125,000 | Downtown Dubai |

| AED 125,000 | AED 85,000 | AED 65,000 | Jumeirah Village Circle |

| AED 190,000 | AED 140,000 | AED 90,000 | Business Bay |

| AED 149,999 | AED 110,000 | AED 80,000 | Jumeirah Lake Towers |

The table below shows the average rental prices for villas in Dubai in Q1 2023:

| Five Bedrooms | Four Bedrooms | Three Bedrooms | |

| AED 480,000 | AED 360,000 | AED 345,000 | Dubai Hills Estate |

| AED 130,000 | AED 134,000 | AED 80,000 | DAMAC Hills 2 |

| AED 410,000 | AED 310,000 | AED 187,500 | Al Barsha |

| AED 460,000 | AED 368,000 | AED 269,999 | Jumeirah |

| AED 450,000 | AED 270,000 | AED 210,000 | DAMAC Hills |

Mortgage Market Performance

Highlights

- The mortgage market in Dubai Q1 2023 witnessed a growth of 19% compared to the same period last year, in spite of the unexpected rise in interest rates and unit prices.

- The mortgage market showed a 60% growth in mortgage applications which reflects that the mortgage market will continue to in the 2nd quarter too

- There are different factors behind this great growth, including the rise in rental prices, which made it difficult for residents to find an affordable home; consequently, many residents turned to the mortgage as a more secure option.

Areas with a Rise in Mortgage Transactions

Due to the rise in property prices and the costs of living, residents tended to move to remote areas. Find below the top remote areas that witnessed a rise in mortgage transactions in Q1 2023:

- Dubai Creek

- Jumeirah Village Circle

- Al Fujran.

Top 5 Nationalities of Borrowers

According to Mortgage Finder data and insights, some nationalities in Dubai showed a great interest in the mortgage option. Here are the top 5 nationalities:

- India

- United Kingdom

- United Arab Emirates

- Pakistan

- Egypt.

You got a full overview of Dubai’s and Abu Dhabi’s real estate market performance in addition to the mortgage market during Q1 2023, supported with all the important information, according to Property Finder’s Data.

For more deep details, download the Property Finder Market Watch report for Q1 2023.