As part of our real estate reports series to help you better understand the dynamics of the real estate sector in the UAE, we are bringing you our second edition of the Property Finder Market Watch.

This series is particularly useful for anyone considering investing in the UAE, as you will want to make sure you have as much information as possible before making an investment.

In this report for 2022, we will wrap up the year and the quarter. Moreover, we will dive into the different factors that contributed to the growth we have witnessed in the sector this year. For a more in-depth look at the quarter, you can download the full report here or click on the download button at the end of this article.

In 2022, the latest stats indicate that about 20% of the UAE’s growth was driven by the construction and real estate activities sectors. As the fourth-largest non-hydrocarbon sector, this sector made up about 8.2% of the non-oil gross domestic production (GDP).

Overall, the real-estate sector performed astoundingly well in 2022, and Q4 saw many new record highs. This includes the most expensive apartment ever sold in Dubai, which fetched AED 108 million, but more on that below.

1. Abu Dhabi

Highlights

- Abu Dhabi’s GDP increased by 11.2% in the first two quarters of 2022 compared to the same period in 2021.

- Up to 80% of acquisitions were made by Emiratis or residents; however, the proportion of foreign investors has begun to rise.

- Demand for new buildings, specifically townhouses and villas, is rising in Abu Dhabi.

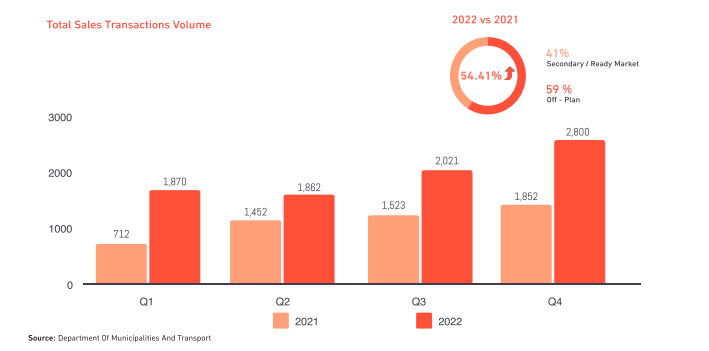

Total Sales Transactions Volume

- Sales transactions in Abu Dhabi increased by 54.4% in 2022.

- Q4 was also a record-breaking quarter, as it increased by 51.2% year-on-year (YoY).

These successes were mainly due to off-plan transactions that have drawn foreign investors.

Over the last few years, Emiratis dominated the Abu Dhabi real estate market; however, we saw a shift in 2022. As the rest of the world has been relatively more volatile during this year, this steered foreign investors towards the UAE.

As a result, the off-plan market has seen significant growth this year. However, demand for the secondary market remains strong, but currently, the off-plan market is more attractive to international investors, who have driven the increase in transactions in 2022.

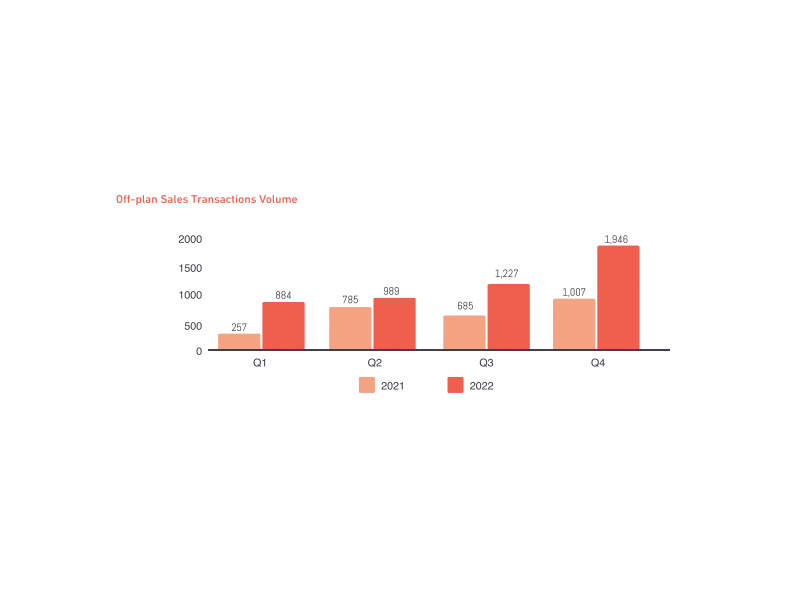

Off-Plan Transactions

- In 2022, the off-plan market has performed extremely well relative to recent years.

- The off-plan market grew by 84.6% in 2022 (vs 2021)

- Off-plan transactions represented 59% of total transactions.

- Q4 witnessed an astonishing 93.2% growth (YoY), which was a 58.6% growth compared to Q3 2022.

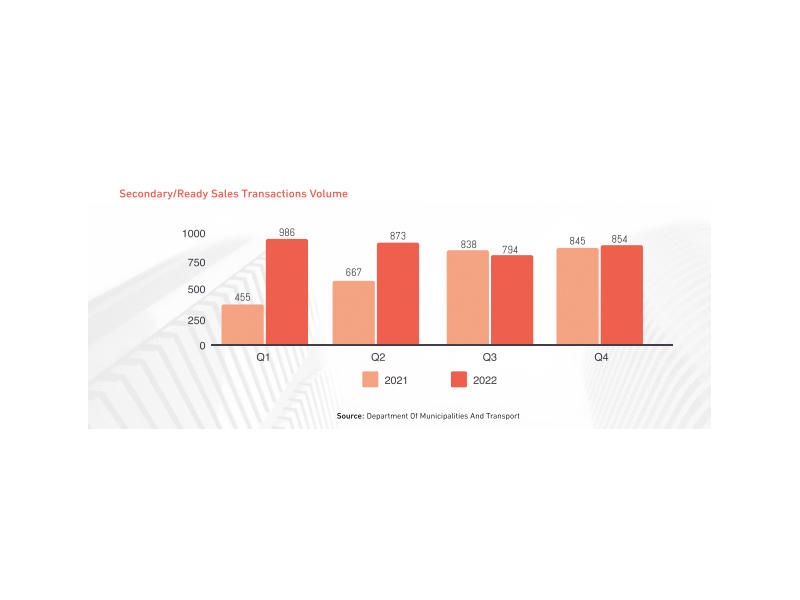

Secondary Transactions

- The secondary (existing) market grew by 25% in 2022 (vs 2021).

- In 2021, it represented 41% of total transactions, compared to 50.6% in 2021.

- In Q4 2022, the secondary market only experienced a slight growth of 1% YoY and 4% compared to Q3 2022.

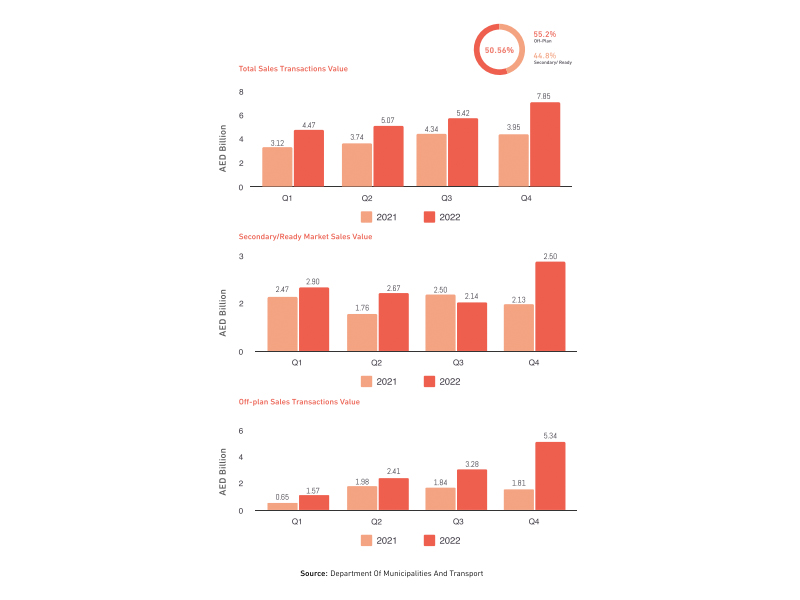

Total Sales Transactions Value

The total sales transaction value increased by a whopping 50% in 2022. Furthermore, Q4 2022 saw a remarkable surge of 98.9% YoY and a 44.7% increase relative to Q3 2022.

Several factors contributed to this success, including the following:

- The UAE’s relative economic stability compared to global volatility attracted international investors.

- Post-covid, the UAE’s tourism industry made a comeback.

- Effective vaccination procedures and reduced COVID-19 restrictions.

Off Plan Transactions Value

- The off-plan properties’ sales value witnessed a dramatic increase of 101% compared to 2021.

- In Q4 2022, the off-plan sales transactions value grew by a tremendous 195% YoY.

- Off-plan sales transactions value contributed 55.2% of the total sales transactions value in 2022, which is an increase compared to 41% in 2021.

Secondary Transactions Value

- In 2022, the secondary market sales value increased by 15.3% compared to 2021.

- In Q4, the secondary transactions value grew by a notable 13% YoY and 17% compared to Q3 2022.

High-in-Demand Areas for Sale and Rent

The following table summarises the most popular communities – most searched – for sale and rent in Abu Dhabi for both villas and apartments.

| Sale | Rent | ||

| Apartments | Villas | Apartments | Villas |

| Al Raha Beach | Al Raha Gardens | Al Khalidiya | Al Reef |

| Al Reef | Al Reef | Al Raha Beach | Khalifa City |

| Al Reem Island | Khalifa City | Al Reem Island | Mohamed Bin Zayed City |

| Saadiyat Island | Saadiyat Island | Corniche Road | Saadiyat Island |

| Yas Island | Yas Island | Khalifa City | Yas Island |

Average Property Sales Prices in Abu Dhabi

According to Property Finder asking price data, the total average sales price in Abu Dhabi climbed noticeably in 2022. The average price for apartments and villas increased by 9% and 2%, respectively, compared to 2021.

The table below shows the average sales prices for apartments in Abu Dhabi in Q4 of 2022:

| Three Bedrooms | Two Bedrooms | One Bedroom | |

| 2,654,119 | 1,697,851 | 1,199,967 | Al Raha Beach |

| 1,055,945 | 779,198 | 592,881 | Al Reef |

| 2,138,451 | 1,415,346 | 859,871 | Al Reem Island |

| 5,494,470 | 3,322,058 | 2,179,129 | Saadiyat Island |

| 2,653,813 | 1,733,865 | 1,095,031 | Yas Island |

The table below shows the average sales prices for villas in Abu Dhabi in Q4 of 2022:

| Five Bedrooms | Four Bedrooms | Three Bedrooms | |

| 4,138,217 | 2,839,652 | 2,427,463 | Al Raha Gardens |

| 2,529,263 | 2,187,534 | 1,575,913 | Al Reef |

| 6,398,232 | 5,232,538 | 4,023,281 | Khalifa City |

| 15,499,999 | 8,100,000 | 5,924,426 | Saadiyat Island |

| 7,079,811 | 5,900,000 | 4,400,000 | Yas Island |

2. Dubai

Highlights

- In 2022, Dubai’s economy contributed about 27% of the UAE’s GDP.

- Real estate activities contributed 9.1% of Dubai’s GDP in 2022, up from 7.8% in 2021.

- Dubai’s GDP expanded in 2022 as a result of initiatives and programmes to stimulate the economy.

- In Dubai, off-plan and secondary property sales had a sharp increase, pushing the market’s volume and value of transactions to all-time highs.

Total Sales Transactions Volume

2022 witnessed a dramatic increase in registered sales of 61.9% YoY, which is the greatest performance for a year in 12 years. This was due to the consistently remarkable performance of each quarter across the year.

Q4 was no exception to the stellar growth of the year; in fact, it broke the record for the highest registered sales for a quarter in the past 10 years.

A major contributor to this record performance was the new government policies that attracted foreign investors. These include the Green Visa and Freelance Visa, made effective as of September 2021, which impact self-employed people and do not require sponsorship. For such a demographic, off-plan properties are more attractive.

Accordingly, the proportion of transactions that were contributed by off-plan property purchases increased from 40% in 2021 to 45% in 2022.

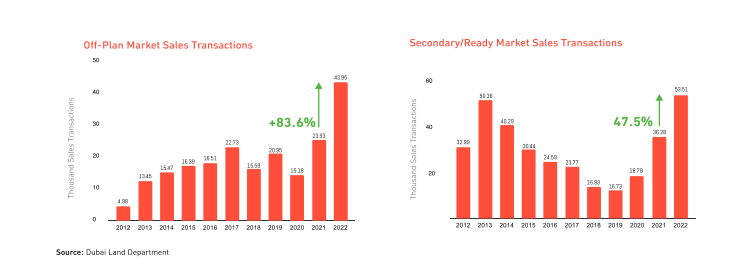

Off Plan Transactions

- The off-plan sales volume witnessed a record 83.6% increase in 2022 YoY.

- In 2022, the off-plan sales volume made up 45% of the total transactions, up from 40% in 2021.

- Q4 witnessed a 91% increase in transaction volume compared to the total off-plan transactions in 2021 and a 26% growth compared to Q3 2022.

- The off-plan market contributed 34% of the total transactions in Q4 2022.

Secondary Transactions

- 55% of all sales transactions were for secondary properties, down from 60% in 2021.

- Despite making up a smaller percentage of transactions compared to 2021, the volume of transactions for secondary properties grew by 48% YoY.

- In Q4 2022, transactions for secondary properties grew by 44.5% compared to Q4 2021.

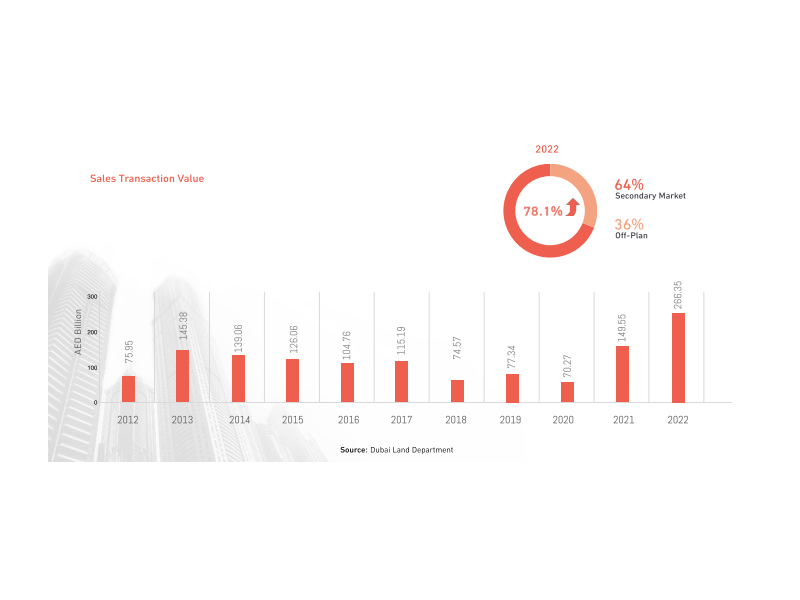

Total Sales Transactions Value

In comparison to 2021, the market value of the sales transactions climbed by 78%, setting a new record for residential sales value. The record-breaking also included Q4 2022, which broke the highest record ever for transaction value for a quarter.

This success can be attributed to a combination of factors that led to a consistent demand for housing:

- Global uncertainty attracted foreign investors to the relatively economically stable UAE.

- UAE’s robust economic growth.

- The revival of tourism in Dubai.

- The extension of the 10-year Golden Visa and new forms of residence permits for retirees and remote employees further attracted foreign investors.

Due to this increase in demand for property, real-estate prices across the board have increased, particularly in luxury units. Villa prices have grown by about 18%, whilst apartment prices have only climbed by about 9%.

Secondary Transactions value

- The overall value of secondary sales increased by 55% from 2021 to achieve the biggest value for a quarter in a decade.

- In 2022, 55% of the total amount of sales transactions were secondary market deals, down from 60% in 2021.

- The secondary market had a notable rise in overall transactions of 63% compared to 2021. This is despite the ready properties’ decreasing contribution to the total value of sales transactions.

Off Plan Transactions value

- The value of off-plan transactions increased to make up 45% of the total value of residential sales transactions in 2022, up from 40% in 2021.

- Offplan sales value increased by an impressive 113% in 2022 (vs 2021)

- Off-plan transaction value set a remarkable record, reaching AED 36.09 billion, up 116% (vs 2021) and 48% compared to Q3 2022.

Rental Performance

Due to the rise in the number of expatriates, rising construction costs, and a hike in interest rates to 4.4% in December 2022, rent prices have surged considerably. Rental prices for apartments and villas rose by 25% and 26%, respectively, in 2022 YoY.

This dramatic increase in rent prices has been impacting tenant behaviour to prefer owning a home over renting. As a result, tenancy contracts decreased slightly by 5% in 2022.

While rent rates are predicted to remain elevated in 2023, the increase is expected to be slow due to an oversupply of properties. This further points to a continued possible shift in Dubai residents’ preferences from renting to purchasing properties.

High-in-Demand Areas for Sale and Rent

The following table summarises the most popular (most searched for) communities for sale and rent in Dubai for both villas and apartments.

| Sale | Rent | ||

| Apartments | Villas | Apartments | Villas |

| Business Bay | Arabian Ranches | Business Bay | Al Barsha |

| Downtown Dubai | Arabian Ranches 2 | Downtown Dubai | Arabian Ranches |

| Dubai Marina | Arabian Ranches 3 | Dubai Marina | Damac Hills 2 |

| Jumeriah Village Circle | Dubai Hills Estate | Jumeirah Lake Towers | Dubai Hills Estate |

| Palm Jumeirah | Palm Jumeirah | Jumeirah Village Circle | Jumeirah |

Average Property Sales Prices in Dubai

The table below shows the average sales prices for apartments in Dubai in 2022:

| Three Bedrooms | Two Bedrooms | One Bedrooms | |

| 3,383,418 | 2,253,722 | 1,347,643 | Business Bay |

| 6,341,610 | 3,799,013 | 1,975,019 | Downtown Dubai |

| 3,460,972 | 2,145,733 | 1,360,128 | Dubai Marina |

| 1,648,689 | 1,156,206 | 737,343 | Jumeirah Village Circle |

| 6,545,672 | 3,653,071 | 2,620,053 | Palm Jumeirah |

The table below shows the average sales prices for villas in Dubai in 2022:

| Five Bedrooms | Four Bedrooms | Three Bedrooms | |

| 7,898,021 | 5,058,373 | 3,408,343 | Arabian Ranches |

| 5,326,795 | 3,960,653 | 2,614,014 | Arabian Ranches 2 |

| 5,261,102 | 2,458,100 | 1,788,981 | Arabian Ranches 3 |

| 6,800,000 | 5,150,755 | 4,141,523 | Dubai Hills Estate |

| 25,900,000 | 19,017,959 | 8,950,000 | Palm Jumeirah |

All in all, this article covers the key takeaways in 2022, as well as some trends and behavioural changes to expect in the market. If you’d like to deep dive even further into 2022 performance, download the Property Finder’s 2022 Market Watch report.