If you are looking into getting a mortgage in Dubai, lots of questions are bound to pop up. Where do I even start? What is pre-approval? What can I afford?

Don’t worry; we’ve got you covered!

We’ve gathered all your most frequently asked questions in one spot so that you can have your burning questions answered. By the end of this article, you’ll be well on your way to finding the right mortgage for you!

- Should I Apply for a Mortgage Before or After I Find the House?

- How Can I Find Out Which Homes I Can Afford?

- Should I Get a Mortgage from My Bank or an Independent Mortgage Advisor?

- Pre-Qualified and Pre-Approved: What’s the Difference?

- What Is the Stress Rate?

- Local Bank vs Global Bank vs Islamic Bank, Does It Make a Difference for My Mortgage?

- What Is the Debt-to-Service Ratio (DSR)?

- How Is the Reversion Rate Calculated?

- What Is the Best Mortgage Product?

- FAQs

1. Should I Apply for a Mortgage Before or After I Find the House?

It’s not unusual for people to assume that applying for a mortgage comes in the later stages of the home-buying journey, but let us tell you why that is not the best idea. In fact, we suggest your mortgage search be your first step in finding your dream house.

We’ll explain why.

- By hammering out the nitty gritty details of purchasing costs, monthly mortgage payments, and so on, you’ll have a crystal clear idea of what kind of properties you can afford. This is extremely helpful in narrowing down your search to properties that are financially feasible for you.

- A pre-approved mortgage is a powerful asset when house-hunting. It not only sets you up as a serious buyer when you start making offers, but it also gives you more negotiating power.

- Lastly, if you do your mortgage search beforehand, you can swiftly make an offer once you find your ideal property.

Having this information in advance means avoiding being rushed when choosing your mortgage because you’re worried someone else might snag up your dream home!

If you’d like to start exploring your mortgage options today, there’s no better place to start than at Mortgage Finder! Partnering with all lenders across the UAE, the expert mortgage advisors at Mortgage Finder can guide you to get the right mortgage for you.

2. Should I Get a Mortgage from My Bank or an Independent Mortgage Advisor?

When it comes to choosing your mortgage, it is best to know all your options. That’s why we recommend working with a reputable mortgage partner, like Mortgage Finder, rather than just settling for whatever mortgage your bank offers, for the following reasons:

- Save you the hassle of researching different lenders’ offers.

- Present you with different options and guide you to choose the right mortgage product for your needs.

- Facilitate all the paperwork and manage the process on your behalf.

- Saving you time and money

Just note: When you are choosing a mortgage partner, you need to make sure they are a trusted entity. An easy way of doing this is checking their Google reviews.

3. How Can I Find Out Which Homes I Can Afford?

This is one of the most critical questions to clarify when you are looking into buying a home in the UAE. Having a clear understanding of which properties you can afford saves lots of time during your home search.

Additionally, having a clear answer to this can help you avoid buying a house with a mortgage that puts you under avoidable financial strain.

To figure out which homes you can afford, let’s start by breaking down the different costs related to buying and owning a property in the UAE. Here are the main costs you need to be aware of:

- Down payment

- Monthly mortgage payments

- Purchasing costs (This is a one-time fee required when buying property in the UAE)

Now, you need to have a good look at your finances to see what you can afford. You need to take stock of the following main factors that will impact which property you can afford:

- Your monthly income

- Your average monthly expenses

- Cash on hand (liquid assets such as money saved in checking or savings accounts)

- Monthly liabilities (e.g personal loans, car loans, etc)

Explore our full listings of Dubai properties for sale

-

Townhouse

Listed 2 weeks ago

4,999,999 AED

Exclusive Type 3E | Large and private corner plot

Al Reem 2, Al Reem, Arabian Ranches, Dubai

3

3

2,436 sqft

-

Villa

Listed 1 week ago

25,999,500 AED

Panoramic View | Refined Luxury | Type 5A

Savannah 1, Savannah, Arabian Ranches, Dubai

5

6

13,650 sqft

-

Villa

Listed 2 weeks ago

13,800,000 AED

Create Your Dream Home | 5BR | Large Plot

Alvorada 4, Alvorada, Arabian Ranches, Dubai

5

5

4,424 sqft

-

Villa

Listed 2 days ago

19,500,000 AED

Luxury 5 BR Villa | Exclusive | Genuine Resale

District One West Phase I, District One, Mohammed Bin Rashid City, Dubai

5

6

8,642 sqft

-

Villa

Listed 3 days ago

21,340,000 AED

High Number| Sunset View | Close to Original Price

Palm Jebel Ali - Frond C, Palm Jebel Ali, Dubai

6

7

7,570 sqft

-

Villa

Listed 3 days ago

152,000,000 AED

Ultra Luxurious | Bvlgari Ocean Mansion | Ready

Bulgari Ocean Mansions, Jumeirah Bay Island, Jumeirah, Dubai

5

7

14,127 sqft

-

Apartment

Listed 3 days ago

9,900,000 AED

Exclusive | Original Photos | Ain Dubai View | VOT

Apartment Building 9, Bluewaters Residences, Bluewaters, Dubai

2

3

1,610 sqft

-

Villa

Listed 2 days ago

21,674,888 AED

New Launch | Water Facing Villa | Call Now

Mareva 2 The Oasis, The Oasis by Emaar, Dubai

5

5

10,618 sqft

-

Villa

Listed 2 days ago

28,400,888 AED

Luxurious Villa | 6BR Water Facing | New Launch

Mareva The Oasis, The Oasis by Emaar, Dubai

6

6

14,939 sqft

-

Apartment

Listed 4 days ago

6,500,000 AED

Full Sea View | PHPP | Furnished by Elie Saab

Grand Bleu Tower 2, EMAAR Beachfront, Dubai Harbour, Dubai

2

2

1,417 sqft

First off, you can determine what down payment and purchase cost you can afford from your savings; and this will come by:

- Looking at your monthly income, expenses, and liabilities.

- See what a comfortable mortgage payment for you would be.

- Be sure to factor in a buffer for each month since your monthly expenses can vary from month to month.

- Don’t put 100% of your savings into a property, in case of any unexpected financial needs.

After gaining a clear understanding of your finances, you can use Mortgage Finder’s Affordability Calculator to easily determine what you can afford. This useful tool takes into account your:

- Upfront payment

- Monthly income

- Financial liabilities

4. Pre-Qualified and Pre-Approved: What’s the Difference?

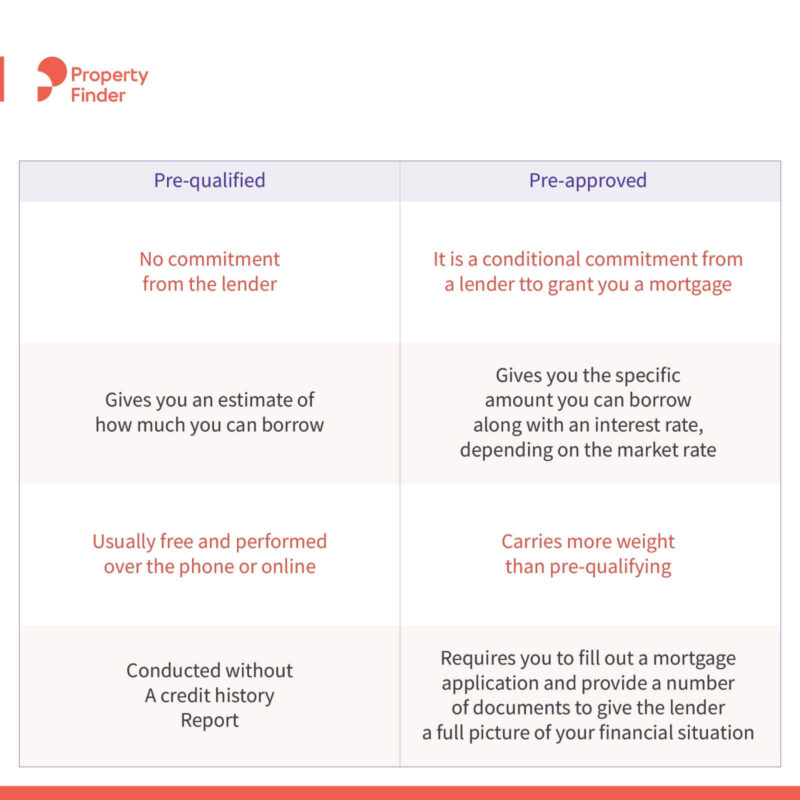

Once you’ve started looking into getting a mortgage, you will likely come across terms like ‘pre-qualifying’ and ‘pre-approval’. Despite these terms referring to very different things, it is common for people to use them interchangeably.

We’ll dispel the confusion once and for all in plain English.

- Pre-qualifying: This only gives you a rough idea of how much money you could borrow based on the information you provide. It does not involve an in-depth analysis of your finances.

- Pre-approval: This involves a conditional commitment from a lender to grant you a mortgage, subject to certain predetermined conditions being met. To make this commitment, the lender conducts a thorough assessment of your financial status to accurately gauge the level of risk involved in lending to you.

Furthermore, the thorough analysis of your finances in the pre-approval is why it carries more weight. Moreover, a pre-approval gives you the privilege of:

- Negotiation power when making an offer, as it positions you as a serious buyer.

- Expedite the mortgage process.

- Facilitate a quicker closing on your dream home!

5. What Is the Stress Rate?

A stress rate is the hypothetical interest rate used by banks to assess whether a borrower can afford the mortgage payments if interest rates were to rise.

Now, Let’s highlight stress rate features:

- Typically higher than the actual mortgage rate.

- Used as a way to determine your ability to withstand financial stress.

- Ensure that borrowers are not put in a difficult financial situation if interest rates increase in the future.

6. Local Bank vs Global Bank vs Islamic Bank, Does It Make a Difference for My Mortgage?

Beyond the bank size or Islamic vs conventional banks, your main priorities when choosing a lender should be the following factors:

- Interest rates

- Fees

- Customer service

- Convenience

By carefully considering all these factors, you can make a well-informed decision and choose the right bank for your mortgage.

Conclusively, as long as you are working with a bank with a central bank licence, whether they are local, regional, or international will not make a difference.

Additionally, we recommend that you don’t limit yourself to the bank where you have your savings account to broaden your financial options.

Moreover, make sure your mortgage advisor is working for you, not the bank.

7. What Is the Debt-to-Service Ratio (DSR)?

The DSR (Debt to Service Ratio) is a metric used by lenders to determine your ability to repay the mortgage loan. In general, a lower DSR is considered more favourable, as it indicates that you have a lower level of debt relative to your income.

Accordingly, you are deemed more likely to be able to pay your mortgage payments on time.

Typically, lenders set a maximum DSR that a borrower must meet to qualify for a mortgage. The specific DSR requirement may vary by lender and by the type of mortgage being offered.

In the UAE, the Central Bank has set a maximum DSR of 50% for mortgages. This means that your total debt obligations, including the proposed mortgage payment, cannot exceed 50% of your gross income.

8. How Is the Reversion Rate Calculated?

The ‘Reversion Rate’ is the interest rate applied to your mortgage once the fixed rate period ends. To elaborate, many people opt for a 1-, 3- or 5-year fixed-rate mortgage, which allows you to have fixed monthly payments for the duration of the term.

After this period, your rate will be calculated according to the ‘reversion rate’.

In the UAE, many lenders calculate the reversion rate based on the EIBOR (Emirates Interbank Offered Rate) added to the bank’s margin.

- Reversion Rate = EIBOR Rate + Bank Margin

For example, a lender may offer a mortgage with an interest rate of [ EIBOR + 2%], which means that your interest rate would be the prevailing EIBOR rate plus an additional 2%.

As EIBOR fluctuates over time, your monthly mortgage payments would also fluctuate accordingly.

Top Tips:

- Compare different banks’ margins, as this will impact the change in your monthly mortgage payment after the fixed rate period.

- Ask about the bank’s ‘floor rate’, which is the minimum interest rate at the end of your fixed-rate period. Some banks apply a higher floor rate than others.

9. What Is the Best Mortgage Product?

The best mortgage product will be the one that fits your unique needs.

Be Aware of Hidden Fees

The bank with the lowest interest rate may not necessarily be the best mortgage lender for you. That is because there are various other hidden fees to consider, such as insurance costs, valuation, and so on.

Accordingly, we recommend asking your mortgage advisor to walk you through the total cost of your mortgage, often referred to as the APR (Annual Percentage Rate).

The APR takes into account the interest rate, mortgage insurance, and any other fees associated with the mortgage. This will give you a more comprehensive way to compare the total cost of different mortgage offers.

Choose a Lender with a Suitable Transaction Cycle

The time it takes to receive your mortgage after submitting the required documents is referred to as the ‘Transaction Cycle’. The transaction cycle can vary between banks from as little as 10 days to 10 weeks.

This time period may also vary depending on the complexity of your mortgage application and the lender’s specific processes. Thus, it is crucial to choose a bank with a transaction cycle that fits your timeline.

Ask About the Tenure

The ‘Tenure’ is the repayment period for mortgages. Some banks are more likely to approve a longer tenure, up to the age of 70. This is yet another factor to consider when choosing between mortgage products.

Overall, navigating different bank products can be tedious and seeking guidance from an experienced mortgage advisor who can guide you through the fine print is invaluable.

FAQs

Going for a mortgage in Dubai is a good alternative to cash purchases, that offers enhanced financial flexibility.

While paying in cash might be more straightforward and possibly more economical in some cases, a mortgage can facilitate better cash flow management.

For those considering a mortgage, it’s crucial to weigh your options carefully and prepare adequately before making this commitment.

For properties valued below AED 5 million, the UAE Central Bank mandates a minimum down payment of 20% for expats who are first-time buyers and 15% for UAE nationals.

For properties valued above AED 5 million, expats are required to make a minimum down payment of 30%, while UAE nationals are required to make a down payment of at least 25%.

Additionally, for buyers who are not UAE residents, the minimum down payment required to purchase a property is 40%, regardless of the property’s value.

By now, most of your burning mortgage questions should be answered. If you’d like even more information, head to Mortgage Finder, where expert mortgage advisors can guide you through the process of finding the right mortgage for your unique needs.

Whether you’re a resident or a non-resident, getting a mortgage can be a walk in the park with Mortgage Finder