Getting to know the factors that impact your property investment in Dubai is super important for making informed decisions. This is especially true when it comes to investing in the dynamic real estate market of Dubai.

In this comprehensive guide, we will take you through the key factors that affect your property investment in Dubai and provide valuable insights to help you maximise your returns.

- Location

- Property Type

- Historical Transactions

- Return on Investment

- Number of New and Renewed Contracts

- Market Status

- Developer Reputation

- Services and Amenities

1. Location

The first step when planning for a property investment in Dubai is to wisely choose its location. It’s an important factor that impacts

- The return on investment in case you’re planning to rent it

- The resale process in the future

- The demand for the property

- The value of the unit

How to Get the Insight

You can easily narrow down your choices and explore different locations by using Data Guru tools on Property Finder.

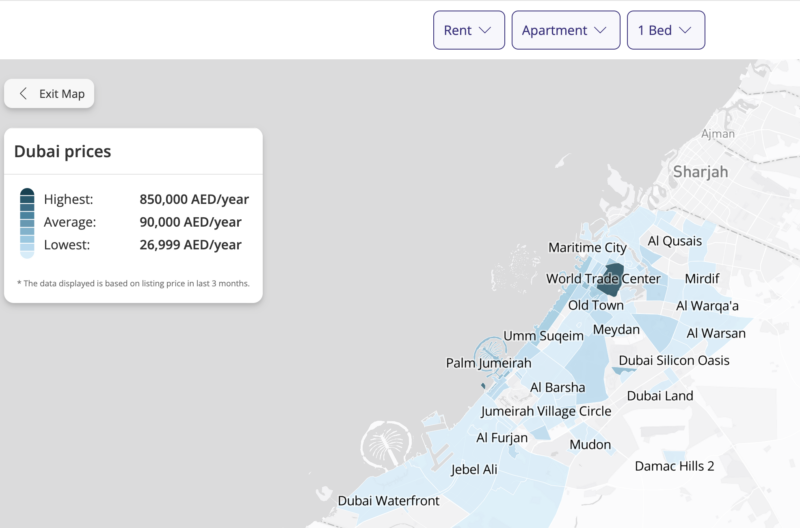

Deeper Look at the Prices. The Price Map tool powered by Data Guru on Property Finder gives you an overlook of the price range of all the communities in Dubai.

More Information About the Communities. With just one click, you can know more about the area you’re interested in with the Community Insights tool.

2. Historical Transactions

One of the factors that you should consider and have visibility over while searching for a property investment is the historical transactions of the community or similar properties.

The historical transaction tells you about

- The past record of sales and rentals that took place in the area and also their average prices.

This gives you valuable insights and a deeper look into the market trends and potential returns for the unit you’re considering.

- The level of demand, price fluctuations, and overall market stability in a particular location.

Accordingly, you will be able to make informed decisions and identify areas or developments that offer the best investment opportunities.

Luckily, you can easily find the information you need about the historical transactions of a unit you are considering with the Historical Transactions tool powered by Data Guru on Property Finder.

It provides you with a list of the historical transactions for the past units that have the same features you entered.

How to Get the Insight

Use the Historical Transactions tool powered by Data Guru on Property Finder.

- Access Data Guru via the Property Finder website.

- Select “Historical Transactions.”

- Enter the unit’s location.

- Use the filters to tailor the information to your needs, including Property Type, Number of Bedrooms, Price Range, etc.

Buying to Rent

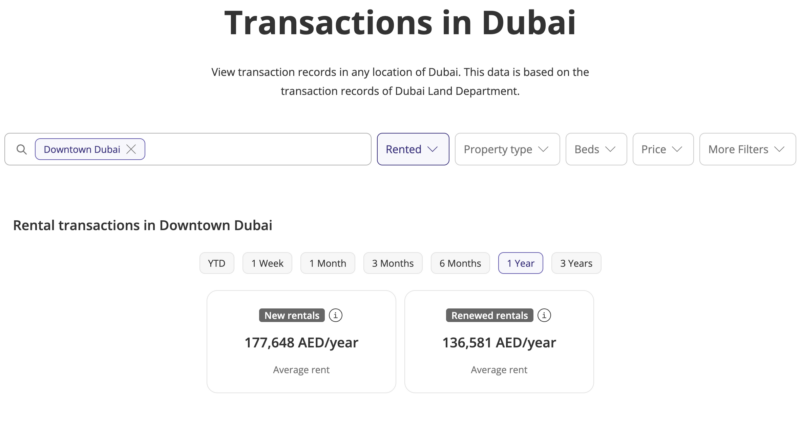

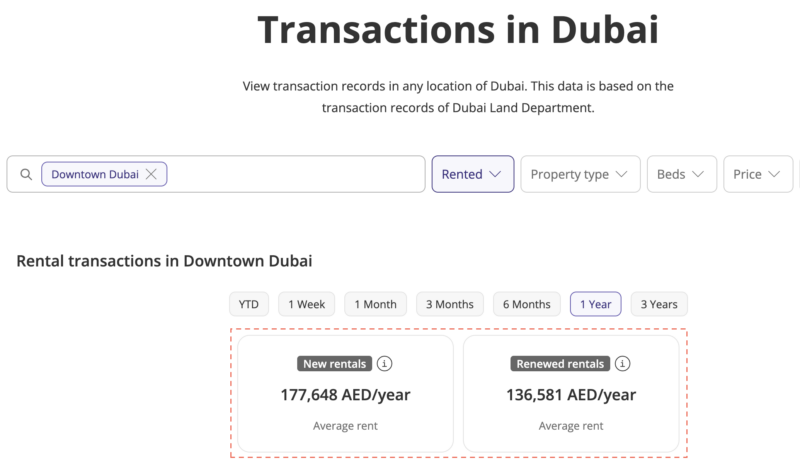

- Ensure it’s “Rented” in the first drop-down menu.

The dashboard that will appear shows you the number of new rented contracts and renewed rental contracts. This gives you visibility over the demand for rent in this area and property type.

Buying an Asset

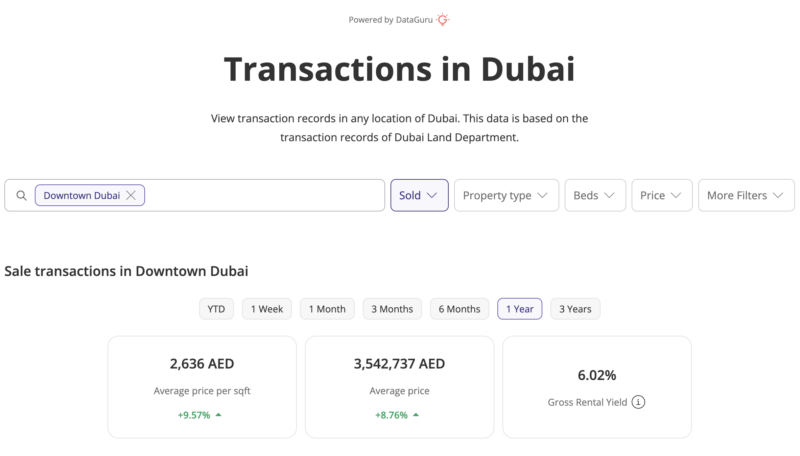

- Make it “Sold” in the first drop-down menu. You will get a list of the historical transactions that took place for this unit and location, including:

- Number of transactions

- Sale Price

- Transaction Date

- Status: Ready for Occupation or Off-Plan Agreement

- Property Type

3. Property Type Size

Choosing the right size and type of property for your investment can really make a difference in your returns.

Spacious Unit

Here in Dubai, spacious properties are a hit because they offer more room and functionality, attracting families or those with a bit more to spend. This means you might see higher rents and a stronger demand for these spacious places.

Moreover, larger properties often have a higher potential for capital appreciation, especially in popular locations where demand for larger homes continues to grow.

Small Unit

However, it is important to consider the target market and demographics of potential tenants or buyers.

In some cases, smaller units, such as studios or one-bedroom apartments, may be more suitable for the local market or specific segments, offering affordability and convenience.

How to Get the Insight

It’s all about striking the perfect balance between market demand and the type of unit you choose. Accordingly, doing research about the market’s demand will help you know what potential renters or buyers are looking for.

Find out about the Demand

You can learn more about it through the Historical Transactions tool powered by Data Guru, as mentioned above. Using it gives you more information about which unit size as demand in a specific location.

Check the Market Watch report by Property Finder.

Market Watch is a quarterly report that includes the market trends, insights, and the high-in-demand areas for rent and sale. You can find it on our blog and can download the full report to have your version.

It’s an essential step to ensure you get the most out of your investment, no matter the size or style of the property.

4. Return on Investment (ROI)

This one comes on the top of the list of the factors that impact your property investment in Dubai which you surely should consider in the planning process.

Calculating the potential return on investment (ROI) is a crucial step in evaluating any property investment. ROI is a measure of the profitability of an investment and indicates how much profit or loss can be expected relative to the initial investment.

In Dubai, ROI can be influenced by factors such as

- Rental income

- Capital appreciation

- Property management fees.

It is also important to account for any ongoing expenses, such as service charges, maintenance fees, and property management fees, to assess the net ROI accurately.

How to Get the Insight

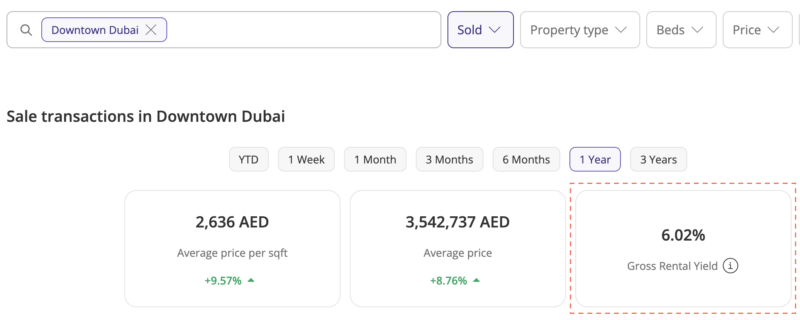

An easy way to have overlook at the estimated gross rental yield is through Data Guru’s Historical Transaction tool; it provides data about the “Gross Rental Yield” for your property search.

By carefully considering the ROI, as an investor, you can make more informed decisions and choose properties that offer the highest potential returns.

5. Number of New and Renewed Rental Contracts

If you’re planning to buy a property to rent it as an investment, the number of new and renewed rental contracts for an area is a valuable indicator of the demand and stability of the rental market.

A high number of new rental contracts reflects a strong demand for properties in the area, indicating potential rental income growth.

Conversely, a high number of renewed rental contracts suggests stability and tenant satisfaction, making the property a reliable source of rental income. Additionally, this helps in the process of choosing the location, as your decision will be data-driven.

How to Get the Insight

Through the “Historical Transactions” tool powered by Data Guru, follow the same steps mentioned above, but one point to consider below.

- Make sure it’s “Rented” in the first drop-down menu.

- Then, you will have a dashboard showing you the number of new rented contracts and renewed rental contracts.

This gives you visibility over the demand for rent in this area and property type. Besides, keeping a close eye on the rental market trends helps you identify the best areas with the highest ROI.

6. Market Status

Understanding the current market status is crucial for making a well-planned investment decision. Dubai’s real estate market is known for its cyclical nature, with periods of growth and stabilisation.

Here is how visibility over the market can impact your investment

- By staying informed about market trends, supply, and economic indicators, you can adapt your investment strategies and go for data-driven opportunities.

- Monitoring government initiatives, infrastructure projects, and developer activities can provide insights into the future supply landscape and potential market shifts.

This information allows investors to align their investment plans with market trends and maximise their returns.

7. Developer Reputation

Having knowledge about the developer and its reputation in the market is among the significant factors to consider, especially if you’re going to get an off-plan unit. Dubai has a diverse range of developers, each with their own track record and reputation.

Investing with reputable developers known for their quality construction, timely delivery, and excellent customer service ensures you peace of mind and minimises the risks associated with off-plan investments.

In addition, you should also look into

- The developer’s previous projects and their financial stability

- Customer reviews can also help you assess their reliability and trustworthiness.

- Developers with a proven track record increase the likelihood of a successful investment and ensure a smooth transaction process.

8. Services and Amenities

When considering investments, it’s crucial to recognise that the presence and quality of community amenities significantly affect the value of property in Dubai.

Most of the city’s communities, boasting facilities like swimming pools, fitness centers, and parks, not only attract tenants but also enhance rental yields and property values.

Proximity to quality education, healthcare, and shopping, alongside reliable security services, offers convenience and a comfortable lifestyle.

How to Get the Insight

You can know all about the community you’re considering through the Community Insights tool powered by Data Guru on Property Finder. It gives you a deeper look over the areas’ services and amenities, like:

- The lifestyle

- Residents ratings

- Average rental and sale prices

- Frequently asked questions about the community

Properties with easy access to these amenities are especially appealing, leading to higher rental income and potential for value growth, making them a wise choice for future renting or selling.

Knowing about the factors that impact your property investment in Dubai leaves you with zero worries and confidence about your final decision. And with these various insightful tools in hand, it’s much easier to have all the information with one click.