You have questions. We have answers.

The home buying process is super simple and straightforward… said no one ever. What’s the step-by-step process to buy a home? Am I eligible for a mortgage? Is this property costing me more than it should? Questions. Questions. Questions. Whether you’re buying your first home or your fifth, you’ll have a lot of questions.

Fortunately for you, we have the answers. Apart from helping you find the home that’s right for you, we can also help you find the answers you’re looking for to simplify the home-buying journey.

In this article we are answering all questions about buying a home in the UAE, scroll down to learn more, and you can also dig deeper into other articles for more information.

Our answers are based on millions of data points and insights, as well as the perspectives of our own industry experts who bring thought leadership to the real estate industry.

Below, we’ve identified some of the top questions people have when they’re looking to buy a home. So let’s jump into the questions, err… the answers.

When it Comes to Home Buying, Where Do I Even Begin?

Buying a home is one of the most important decisions you’ll make. With all the questions and doubts in your mind, it’s natural to wonder, “where should I even begin?” First, take a deep breath. And then start to break down the process into small decisions.

Figure out the following details.

- What’s my budget?

- What kind of neighbourhood do I want? Fast-paced metropolitan or calm suburban-style area?

- Do I actually want a backyard, or would a rooftop garden be so much cooler?

- When do I want to move in?

- Am I buying the house to live in or as an investment?

Once you have the answers to these questions, you can focus your search on specific communities and property types. On Property Finder, you can use filters like the number of bedrooms, areas you’re interested in, amenities you want, etc. Download our App now and start exploring properties on the go.

Based on these filters, you’ll find thousands of options on our portal. Once you’ve identified the home you think checks all your needs, the next step is to find an agent you can trust. Did you know Property Finder is the only portal that has SuperAgents? They’re the best agents in town who give you accurate information and respond faster.

Only the very best earn the‘SuperAgent’ status. That’s not an opinion. It’s a ranking given by ADA – our unique artificial intelligence program. These are agents who respond faster and give accurate information in their listings. Here’s a list of our SuperAgents so that you get the support you need through your journey.

They guide you through the entire process with their expertise and stellar customer service. Though the home-buying journey can feel challenging, with the right partner and tools, we can make it an absolute pleasure.

Insights Anchor

How Can I Know if the Price I’m Paying for the Property Is a Fair Market Price?

A home is often the biggest investment people make in their lifetime. When you’re paying so much, it’s only natural that you want to be certain you’re getting good value for your money. To add to the confusion, everyone you know will have an opinion. (No, you don’t have to listen to what your coworker’s brother-in-law’s step-sister said she paid for her 2-bedroom apartment.)

So what should you do? Do your research. At Property Finder, we’ve got data-driven insights that make this step really easy. Check out Prices & Trends, a feature that gives you insights into how the property compares to other properties in the area in terms of size and price, average market price of properties in the area, etc.

All these hard facts will help you objectively judge if the property’s price tag is truly worth every penny and be able to buy like a pro.

Superagent Anchor

How Can I Find a Real Estate Agent I Can Trust?

There are two milestones in your home-buying journey. First, to find a home that’s right for you. Second? Finding an agent you can trust. A competent and skilled real estate agent can make your home-buying journey as enjoyable as it is simple. You want an agent who’s transparent, knowledgeable and a great listener. Essentially, someone who understands your needs and has the expertise to guide you every step of the way.

Meet Property Finder’s SuperAgent. Only agents who are obsessed with great customer service, give accurate information and respond fast earn this coveted status on our portal. Agents earn the SuperAgent tag on the basis of millions of data points collected by our artificial intelligence program. So you know it’s unbiased and precise.

With SuperAgents, you can be sure that you’re working with someone who meets our highest standards for responsiveness and support. And more importantly, is an expert who can simplify your home-buying journey by answering your every question. Often before you ask it. Find your SuperAgent today!

Should I Apply for a Mortgage Before or After I Find the House?

When it comes to applying for a mortgage, it’s natural to think, “I haven’t even found the right home. I’ll think of a mortgage later.” It’s not unusual to think that way. But it actually makes a lot more sense to start your mortgage research before finding your new home. Here’s why.

- Doing your mortgage research will give you a clear idea of which properties you can afford to buy, helping you narrow down your property search.

- If you have a pre-approved mortgage in hand, you’ll have more negotiating power when you start making offers.

- Lastly, you don’t want to be in the position of having found your dream home, wanting to make an offer quickly, and then rushing your choice of mortgage. Exploring your mortgage options beforehand means you’ll be under less pressure and you can take your time choosing between the different options presented by your mortgage advisor.

Did you know that Property Finder is the only property portal with a dedicated mortgage provider, Mortgage Finder?! Powered by Property Finder, Mortgage Finder partners with all lenders in the UAE and has dedicated and expert mortgage advisors to help you find the right mortgage for you.

What Are Primary Properties?

A primary property is a brand-new property that has never been previously owned. In a nutshell, buying a primary property means you will be its first owner. You can buy it directly either through the developer’s sales team or through a broker.

Note that primary properties can be ready to move in, but most are off-plan (i.e under construction). Because you’d be the first owner, primary properties are generally considered a great option for investing.

Whereas secondary properties are ones that are previously owned and not by a developer. Secondary properties have the benefit of being more mature. As a result, you’ll have a better idea of what it would be like to live in the property, from amenities to maintenance and even your neighbours.

Both primary and secondary properties have their pros and cons; knowing them helps you decide which suits you more.

Buying a Home FAQs

1. How can I find out which homes I can afford to buy?

One of the most defining questions you’ll have to answer during your home-buying journey is: “Can I actually afford this?”.

Without clearly answering this question, you could fall in love with a gorgeous flat that turns out to be out of your price range. Alternatively, you might settle for a smaller space when you can actually afford a more luxurious home. That’s why it is helpful to define what your budget is early on in your home-buying journey.

We’ve got a few ways to help you with this!

Let’s lay down the groundwork. First, you need to be aware of all the costs associated with buying and owning a home in the UAE. This includes the following:

- Down payment

- Monthly mortgage payments

- Purchase costs (One time costs and fees payable when purchasing a property in the UAE)

Don’t worry! You don’t have to figure these out on your own. We took the guesswork out of it with a Mortgage Calculator under each Property Finder listing that calculates all of these expenses for you.

Next, the kind of home you can afford will depend on five key factors:

- Your monthly income

- What your average monthly expenses are

- Any monthly liabilities you have (for eg. car loans, personal loans, etc)

- Cash on hand, that is, any liquid assets you may have, such as money saved in checking or savings accounts

- Your savings targets

Take some time to take stock of each to have full visibility of your finances. This will allow you to estimate how much you can afford to pay in a down payment and the purchase costs, which will likely come from your savings. Next, you can see what would be a comfortable monthly mortgage payment for you.

Bear in mind that you should give a buffer for your expenses since they can vary. For example, your monthly expenses can vary from month to month. Thus, it would be wise to give yourself enough wiggle room so that you’re not absolutely strapped for cash on some months and struggle with your mortgage payments.

Once you’ve got a clear picture of your finances, check out Mortgage Finder’s handy Affordability Calculator for a super simple way of assessing what you can afford.

It lets you know what properties you can afford based on what you can pay upfront, your monthly salary and liabilities.

2. Can I get a residency visa by buying property in Dubai?

Yes! Investing in real estate in Dubai can be a gateway to establishing a stable and secure life in Dubai. You can be eligible for different types of residency visas through investing.

3. How much do I need to invest to be eligible for a permanent residency visa?

Currently, the closest thing to a permanent residency visa in the UAE is the Golden Visa, which is valid for 5 to 10 years and is easily renewed. This visa allows foreigners to live, work or study in the UAE, as well as receive special benefits.

There are several ways, other than investing, to receive a Golden Visa, but if this is your preferred route, you’ll need to invest in a property worth at least AED 2 million* to qualify for it.

4. What is the difference between ‘Pre-Qualified’ and ‘Pre-Approved’?

If you’ve started looking into mortgage applications, you might have come across these two terms. While some people use them interchangeably, they are quite different, and it’s important to understand how. Don’t worry, we’ll break it down into simple terms!

‘Pre-qualifying’ simply gives you a general idea of how large of a loan you can qualify for, and it calls for a less rigorous assessment of your finances.

‘Pre-approval’, on the other hand, includes a conditional commitment from a lender to grant you a mortgage as long as some predetermined conditions are met. Accordingly, to provide this commitment, the lender needs to thoroughly assess your financial standing to get a clear picture of the risk they would be taking on you as a borrower.

Because the pre-approval actually involves a commitment from the lender, it holds much more weight than ‘pre-qualifying’. That is why we recommend having a pre-approval in hand before making an offer on a property, as this will strengthen your negotiation power and position you as a serious buyer.

Moreover, it will also accelerate the process of you getting a mortgage and help you close faster once you find your dream home! The validity of your pre-approval will vary from one bank to another, so make sure you partner with the right mortgage advisor who can guide you to the best option.

| Pre-qualified | Pre-approved |

| Gives you a rough idea of how much you can borrow based on the information you provide to the lender. | Gives you the exact amount you can borrow, including an interest rate based on the current interest rate. |

| Usually done free and conducted online or over the phone | Holds more weight than ‘pre-qualifying’ |

| It is done without a credit history report | Requires that you complete a mortgage application and submit several documents to provide the lender with a thorough understanding of your financial circumstances |

| Accelerate the buying process |

5. How do I know that the property in the advertisement is actually available?

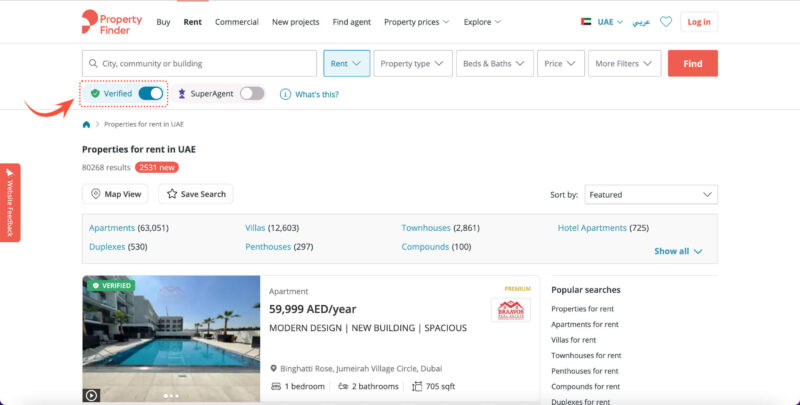

At Property Finder, we want to make absolutely sure that what you see on our listings is exactly what you get, from pictures to pricing. That’s why we created a verification process where we check the property’s location, price and the validity of its documentation.

Only listings that pass our screenings are given the ‘Verified’ tag. Use the ‘Verified’ toggle while searching for properties so that only verified properties that have passed Property Finder’s rigorous checks show up.

6. How to know the average house price in Dubai?

Property prices in Dubai can vary significantly from community to community. However, having an idea of the prices in each community will help you determine which communities work with your budget.

To make it simple for you, use Property Finder’s nifty House Prices tool to find out what the average asking sales price for different types of properties in each community in Dubai.

7. How much have similar homes sold for in the neighbourhood?

Knowing the average price of similar properties is an invaluable tool. Why? Well, knowing what similar properties go for lets you know if you’re getting a bargain or if the seller is asking for way too much. In the latter case, this information gives you some leverage to negotiate the price down.

Check the ‘Properties Like This’ table under each Property Finder listing. You can see real data of what similar properties have been sold for. Additionally, you can check the ‘Prices & Trends’ feature that compares the price of the unit relative to the surrounding community.

8. What’s the difference between freehold and leasehold?

Freehold ownership gives you complete control of the property without any restrictions. If the property value exceeds AED 1 million, this type of ownership entitles the owner and their immediate family to renewable UAE residency visas.

Plus, whether or not there is a will, the property’s ownership will be transferred to the owner’s heirs upon their death.

In contrast, leasehold ownership allows you to own the property (but not the land it is built on) for a specified length of time, up to 99 years. Leasehold properties can be sold, used or rented just like freehold properties, with a few minor limitations.

For example, the leasehold owner would need the written approval of the freehold owner of the property to carry out any renovations. On the other hand, the benefit of leasehold ownership is that since freehold real estate available to expats is limited to certain areas, leasehold properties offer foreigners more choice in terms of price and communities.

9. Can foreigners buy property in Dubai?

Yes! Don’t be discouraged from buying property in Dubai as a foreigner. Foreigners can buy property in Dubai in freehold areas designated by the Dubai Land Department (DLD).

10. What’s off-plan?

An ‘Off-plan’ property is one that is still under construction. You may wonder why someone would buy a property that isn’t ready, but buying off-plan comes with many advantages.

Firstly, off-plan properties are often much cheaper than their ready counterparts, so if you’re in no rush to move in quickly, then off-plan properties make for a great investment option. To boot, with off-plan properties, you can enjoy the latest designs and cutting-edge amenities.

11. Should I buy or rent?

It can be a bit challenging to assess whether renting or buying a home is the right decision from a financial point of view. This can be even more complicated when you’re not sure of the extra fees and costs that come with purchasing a home.

We have made this super simple with Property Finder’s Rent-vs-Buy Calculator.

This calculator breaks down how much buying or renting will cost you, including all the associated fees with each option. The calculation will be impacted based on the following key factors:

- How long you plan on staying in the property

- The selling price of the property

- The rental rate of the property if you decide to rent

As you play around with the calculator, you’ll notice that buying property may actually cost you less in the long run compared to renting in some cases. That’s why we recommend using the calculator for a definitive answer on whether renting or buying is the best financial decision for you.

12. How many homes should I view before I buy one?

As many or as few houses as it takes to find your home.

To make your search for your new home quicker and more efficient, let a SuperAgent be your guide through this journey. With their expertise, they can guide you through the different communities and properties to find one that already feels like home.

13. How Much Can I Borrow for a Mortgage in the UAE?

In the UAE, the value of the mortgage you can qualify for will be based on two factors:

- The mortgage can not be greater than 7 times your annual income (or 84 months)

- All your monthly debt liabilities (including the mortgage, credit card debt, personal and car loans, etc) cannot exceed 50% of your monthly salary.

You can also check out Mortgage Finder’s Affordability Calculator to calculate which mortgages you could qualify for

14. How can I negotiate the best price for a property in the UAE?

One of the best tools you can have in your negotiation toolkit is knowing the value of similar properties in the market. Knowing how much similar homes are going for will give you a good benchmark to aim for when negotiating.

This tip works whether you’re renting or buying. When you look for a home on Property Finder, check out the ‘Properties like this’ table to see what would be a reasonable rental or sale price for such a property.

15. What Are the Legal Documents Required for a Home Purchase in the UAE?

To complete the process of buying a property in the UAE, you will need the following documents:

- The signed contract of F Form

- Original identification documents of both seller and buyer (Emirates ID & passport)

- A payable cheque for the property price

- The original No Objection Certificate (NOC).

16. Can I Sell my Off-plan Property in the UAE if it Is Mortgaged?

Yes, it is legal to sell your mortgaged off-plan property in the UAE. That being said, many developers will only allow you to re-sell the property after a certain percentage of the property’s value is paid off.

The percentage can be around 30- 40%, but it is best to check with the developer for their specific re-sale policy.

17. How Do I Verify the Authenticity of a Property?

With Property Finder, you don’t need to be a legal expert to be sure that a property is authentic. We do all the heavy lifting for you!

When searching for properties on Property Finder, use the “Verified” tag. Only properties that have passed all of Property Finder’s rigorous verification process are given this tag.

Additionally, Madmoun, a new service from the Dubai Land Department (DLD), has been integrated into the Property Finder’s platform. This service will confirm a property’s legitimacy and authenticity to make sure RERA has approved it.

18. How Long Does It Take to Complete a Home Purchase in the UAE?

Buying a house in the UAE typically takes 2 to 10 weeks. However, if you are buying a property that is already mortgaged, it can take longer to finish the procedures.

19. What Are the Maintenance Costs Associated with Owning a Home in the UAE?

On average, it costs 2% of the property value to maintain the unit on a yearly basis, aside from the mortgage payments. For example, maintaining a 2-bedroom apartment worth AED 3.1 million could cost around AED 62,000 annually.

One option to reduce maintenance costs is to get an annual maintenance contract. The contract will provide you with unlimited access to maintenance services, such as plumbing or electrical repairs.

Since annual maintenance contracts can start from around AED 1,300, they can significantly reduce your yearly maintenance expenses.

20. Can I Obtain a Mortgage Without a Job in the UAE?

To be eligible for a mortgage in the UAE, whether you are a UAE national or an expat, you need to be able to prove you have a stable income.

You can be eligible for a mortgage either as a salaried employee or self-employed, as long as you meet the minimum income requirements.

Minimum salary requirements:

- For UAE Nationals: AED 7,000 ($1,900)

- For Expats:AED 10,000 ($2,700)